Washington Policy and Analysis with the support of the American Gas Foundation conducted the study "Fueling the Future: Natural Gas & New Technologies for a Cleaner 21st Century" to address a paradox that has bedeviled the U.S. natural gas industry at least since the wellhead price of natural gas was deregulated in the early 1980s: How can a fuel that is domestically abundant, safe and reliable to deliver, more environmentally friendly than oil or coal, and nearly four times as efficient as electricity from the point of origin to the point of use, power only about one-fourth of the American economy? This paradox is all the more puzzling given the fact that it has been national policy, as affirmed by successive U.S. presidents going back to Ronald Reagan, to encourage the broader use of natural gas.

"Fueling the Future" both posits and proves that a national energy policy encouraging the use of natural gas has not been fully realized. It then outlines a comprehensive strategy showing how fulfilling the potential of natural gas will help the United States better meet its energy needs for the next 20 years. Specifically, it addresses the questions of how much natural gas might be used and in what applications, as well as what national benefits — environmental, economic, conservation — might result from such increased use.

In sum, "Fueling the Future" offers the nation's energy decision-makers, from the leaders on Capitol Hill and in the state capitals, to the consumers on Main Street, an alternative economic future in which an affordable, efficient and readily available energy source powers new, advanced technologies for the betterment of all.

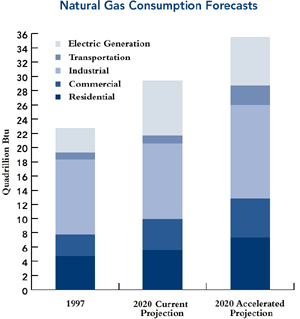

The current projection in "Fueling the Future" is not merely a constrained, "business-as-usual" scenario. It assumes significant increases in the efficiency of equipment that uses natural gas as well as continued technological advances in energy supply and energy use. However, it does not account for the removal of barriers or the adoption of policy measures that would stimulate gas consumption.

In contrast, the study's accelerated projection does assume the removal of barriers and the implementation of positive policies. Under this scenario, overall natural gas consumption is estimated to reach 35 quadrillion Btu (quads) by 2020, more than 20 percent more than what is forecast under the current projection. In 1998, 21.9 quads of natural gas were consumed in the United States.

More important than the level of overall consumption is the pattern of consumption. That is, the accelerated projection shows relatively higher levels of gas consumption in the residential, commercial, industrial and transportation sectors but somewhat less gas consumption by central-station electricity generating plants.

Key Findings

Using natural gas in place of other energy sources provides multiple national and consumer benefits. Substituting natural gas, pr1marily for electricity, coal and oil, help ease a number of environmental concerns, including greenhouse gas emmissions, acid rain, smog, solid waste and water pollution

In 2020, for example, emmissions of carbon dioxide, the primary "greenhouse" gas, would be reduced by an estimated 930 million tons annually if the increased use of natural gas projected in this study is achieved.

The use of natural gas also reduces the the United States' dependance on imported oil. If gas use increases by the amount projected in the accellerated costs, oil imports will be reduced by an estimated 2.6 million barrels per day

Further, due to the high quality of the natural gas system and natural gas appliances, energy consumption is 6 percent lower in the accellerated scenario than in the current scenario

By implementing appropriate policies, natural gas use could be increased by 20 percent. Under the accelerated projection, natural gas consumption in 2020 is more than 35 quads a year,

nearly 6 quads above the demand forecast of the current projection. Nearly half of the increase comes in the residential and commercial sectors, where more new customers are choosing natural gas and more existing customers are switching from other fuels to natural gas.

nearly 6 quads above the demand forecast of the current projection. Nearly half of the increase comes in the residential and commercial sectors, where more new customers are choosing natural gas and more existing customers are switching from other fuels to natural gas.

This scenario also shows continued expansion in the amount of natural gas sold for relatively new applications, such as residential gas fireplaces and commercial gas cooling systems. In addition, distributed generation in the form of reciprocating engines, microturbines and fuel cells advances is anticipated, accounting for roughly 20 percent of all new electricity generating capacity.

Industrial gas demand could grow over the next 20 years by approximately 2.5 quads under the accelerated projection, continuing the robust growth of the past 10 to 15 years. Although the cogeneration market becomes fairly saturated, other forms of distributed generation are expected to prosper. Highly efficient heating, cooling and process equipment continues to evolve, enabling natural gas to remain the dominant source of energy for the nation's factories.

Natural gas-powered transit buses, trucks, vans and cars consume about 1 quad more natural gas under the accelerated projection than under the current projection. Although these vehicles account for less than 1 percent of the overall vehicular market in 2020, they can make significant contributions to air quality and operational economics, primarily in fleet applications in congested urban areas.

Although natural gas consumption used by central-station power plants to generate electricity more than doubles by 2020 under the accelerated case, it is about 1 quad less than under the current projection. Natural gas remains the dominant fuel for new generating capacity even though some new coal-based capacity is added after 2010.

More important, under the accelerated scenario, a lower amount of new generating capacity will be required than under the current projection. The accelerated scenario assumes that the lives of some existing nuclear and coal power plants will be extended and that strong growth will occur in the use of distributed generation. See page 37 for specific policy recommendations that would enable the realization of the accelerated projection.

New technologies and gas source flexibility will ensure adequate supply The decade of the 1990s has demonstrated the vast and diverse nature of the gas resourse base. Further, the resource base continues to "expand"—estimates of its size are larger today than in the early 1990s despite the fact that the nation consumed more than 150 trillion cubic feet (Tcf) of gas from the resource base during that decade. Some sources of today's gas supply, such as coalbed methane, were not even acknowledged 10 to 15 years ago. Now, coalbed methane, which was not included in most resource-base estimates before 1988, accounts for 6 percent of domestic gas production.

Tremendous technological advances in natural gas exploration and production also have occurred in the past 10 years, including three-dimensional seismology, horizontal drilling and innumerable computer-related breakthroughs. Similar advances are required, and expected to take place, over the next 20 years to enable the achievement of the projected 35-quad gas-demand level. With such advances, domestic gas production can increase from today's 19-plus quads to more than 29 quads in 2020.

Canada will contribute a slightly greater share of total supply in the future by increasing its exports to the United States from 3 quads to roughly 5 quads a year. Abundant gas resources worldwide and in Alaska offer mid-term insurance while methane hydrates and other more exotic sources of gas provide long-term potential.

Signifigant but

reachable gas infrastructure expansion is needed to support higher demand. The natural gas industry is very capital-intensive, and significant expansion of its production, storage, transmission and distribution systems will be needed to meet the higher demand level of the accelerated projection.

reachable gas infrastructure expansion is needed to support higher demand. The natural gas industry is very capital-intensive, and significant expansion of its production, storage, transmission and distribution systems will be needed to meet the higher demand level of the accelerated projection.

For example, the number of oil and gas wells drilled each year may have to double from today's level to about 50,000 wells. This number, however, is well below the peak levels experienced in the mid-1980s when 70,000 to 90,000 wells were drilled each year. The ramp-up for the production segment may prove to be more challenging than the expansion required of the transmission (interstate pipeline) and distribution (local utility) segments.

Gas prices will remain competitive even as demand increases. Price regulation of natural gas was eliminated about a decade ago. From 1987 to 1999, the price of gas delivered to consumers increased by only 3 percent while consumer prices overall rose by 36 percent. Thus, natural gas prices have declined significantly in "real," or inflation-adjusted, dollars during this period of deregulation.

The main factor in this price decline has been the steady downward movement in the cost of transporting and distributing natural gas through the nation's pipeline and utility systems. This downward movement is attributable to efficiency gains that have reduced the cost of the transmission and distribution component of gas service by 35 percent, in inflation-adjusted terms. The wellhead price of gas also has decreased, in real dollars, during this period, even though the movement of wellhead prices was more erratic and less pronounced than movement of the transmission and distribution component.

While the gas demand levels analyzed in this study will exert a bit more pressure on prices than the demand levels in other forecasts, the study expects only modest gas price increases over the next 20 years. Wellhead prices will remain in the mid-$2 range, and gas prices to consumers will be relatively constant, in real dollars. The expansion of the gas resource base and technological advances related to finding, producing and delivering gas are expected to continue.

The factors that led to declining, inflation-adjusted gas prices in the past should not be considered aberrations. These same factors will make possible future price stability, and an increasingly competitive energy market will ensure this stability.

Although a challenge,

the higher gas consumption levels of the accelerated scenario and the resultant national benefits are achievable. The accelerated projection may be viewed as optimistic from gas production and consumption perspectives, but it is also realistic and achievable. It is based on technologies and practices that are available today or that in all likelihood will be available will be available within the timeframe of this study.

the higher gas consumption levels of the accelerated scenario and the resultant national benefits are achievable. The accelerated projection may be viewed as optimistic from gas production and consumption perspectives, but it is also realistic and achievable. It is based on technologies and practices that are available today or that in all likelihood will be available will be available within the timeframe of this study.

Further, the rate of advance embodiment in the accelerated projectionsis similar to what has been realized recently. The 1990s saw dramatic improvements in terms of energy-related equiptment and services. The ability to find and produce gas, to use gas in cleaner and more efficient applications, and to provide adequate supplies of gas in an increasingly competitive market is far superior to what it was 10 or 20 years ago. The accelerated projection embodies the assumption that such progress will continue and even intensify in the years 2000 and beyond

Specific actions must be taken to realize the potential of the accelerated projection. Although the potential national benefits of the accelerated projection are pronounced, they will not be realized unless certain key actions occur. A number of such actions that would increase gas consumption, through the removal of barriers or implementation of stimuli, are included in this document.

The purpose of this document is to identify measures that would increase gas consumption and the benefits to the nation that would accrue from higher usage levels. It is not meant to recommend the adoption of these or related policy measures.

Back to Table of Contents